Blog

My client recently handed me a letter from the U.S. Department of Homeland Security, U.S. Customs and Border Protection. I read it and started to give some thought to what a “non-lawyer” would think about all the confusing legal terms, sometimes referred to as legalese. That is, I thought, “what if I got such a powerful letter that state I was being given notice under that is “required by 19 U.S.C. Section 1607 and 19 C.F.R. 162.45.” The letter then went on to state that the Government was seizing the property with the intent to forfeit and sell, or otherwise dispose of the described property “according to the law” that was used in or related to a violation of United States law. What is the best way to explain what all that is about? And that was only the first half of the letter, so I will do my best to explain the first half of the letter. After I do that, I will attempt to explain the other half.

First of all, I am going to call the “Legal Notice of Seizure Letter” the “Seizure Notice” which you may receive as a letter in the mail, or you may see it on the www.forfeiture.gov website. Either way, the letter is giving you the federal law which allows the Government to have the right to start the proceedings. It does NOT mean that they will win their case to get your “stuff” because you may have a good lawyer! It does NOT mean the Government has the absolute right to take your property, it just means that those code sections are what give the Government the authority to try to take your property.

19 U.S.C. Section 1607 states that if the property has a value of $500,000.00 or less and the Government believes that the property, which could be a boat or an automobile, was used to transport illegal items or was purchased by the proceeds of illegal activity like selling drugs, the Government’s theory is that if their property and they have the right to it. The same is true of cash. If the Government believes that they have found $500,000.00 or less of cash and they believe it is drug money or money from the sale of counterfeit cigarettes or any illegal, the law says that if they give you notice to contest or fight the case, and they win, the property is the Government. On the other hand, your lawyer may be able to show that the Government does not have the evidence to prove that the money or property was obtained or used for any illegal purpose. This section of the law deals primarily with “controlled substances” or drugs.

The Notice of Seizure goes on to expand its web or control through 19 C.F.R. 162.45. “C.F.R.” simply means Code of Federal Regulation. So this code goes on to put the recipient of the Notice of Seizure letter on “notice” or “make aware” that the other property that can be seized includes not only the drugs themselves, of course, but also any conveyance used to transport, hide, or otherwise facilitate the criminal activity. So all the fancy cars, boats, airplanes, and even submarines that have been allegedly used to import, export, store, or otherwise help to facilitate the sale, transportation, or distribution of drugs can be seized and the parties involved will have the opportunity to make their case on why the property was not a part of a drug distribution scheme. The Federal Code Section also includes any purchases that have been made with the proceeds of the illegal sale or distribution of drugs. The “Feds”, as we call them, could take the diamond necklace right off the neck of the drug lord or “Traficante’s mistress” during a beautiful sunset dinner cruise on the yacht which the Government claims was purchased, traded for, or otherwise transferred to an individual, even if that person had no idea that the funds were alleged drug proceeds. Straight out of the movies!

The silver lining in this ominous black cloud is that you may have an “innocent owner”, “innocent spouse”, or any variation of a person with an ownership interest in the property that could successfully get all or part of the property returned after it is seized by the U.S. Government. Recently, I represented a commercial carrier bus company wherein a passenger slid a duffle bag with 15 kilos of a controlled substance under somebody else’s seat and the bus was stopped and seized. I negotiated with the Government to get a $15,000.00 bus back for $500. It can be done, but your lawyer needs to know what he or she should do in certain situations.

The remaining parts of the Seizure letter go on to explain that you can make different types of claims to get your property returned. You may file a claim and cost bond of 10% of the APV or appraised property value with the fines, penalties, and forfeitures department and get your claim sent to the District Court immediately. Another avenue is the petition for remission and mitigation, wherein you write a letter explaining why the property should be returned to you. You may also offer to compromise, or simply forfeit the property without contesting the seizure. Whatever you decide to do, consult with a lawyer trained and experienced in this area of federal law before making your election of proceedings.

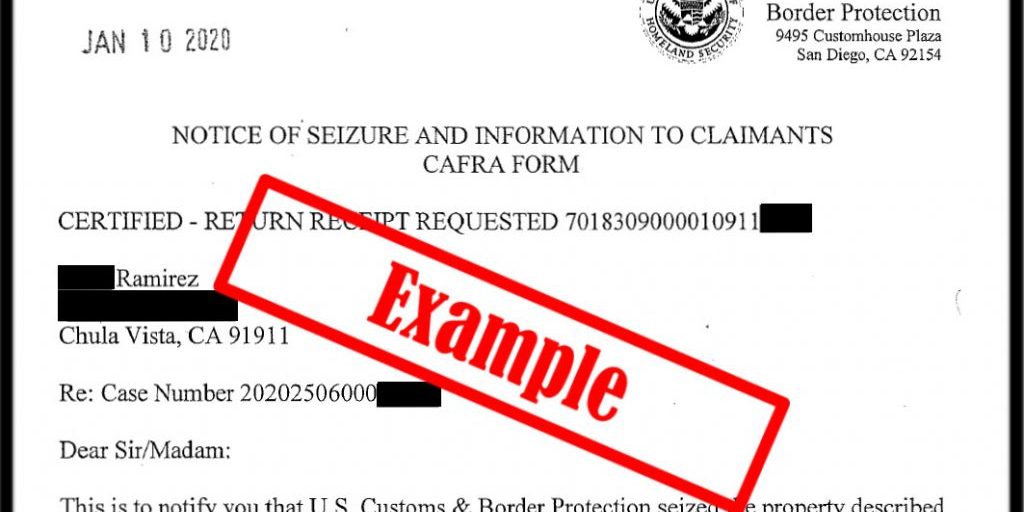

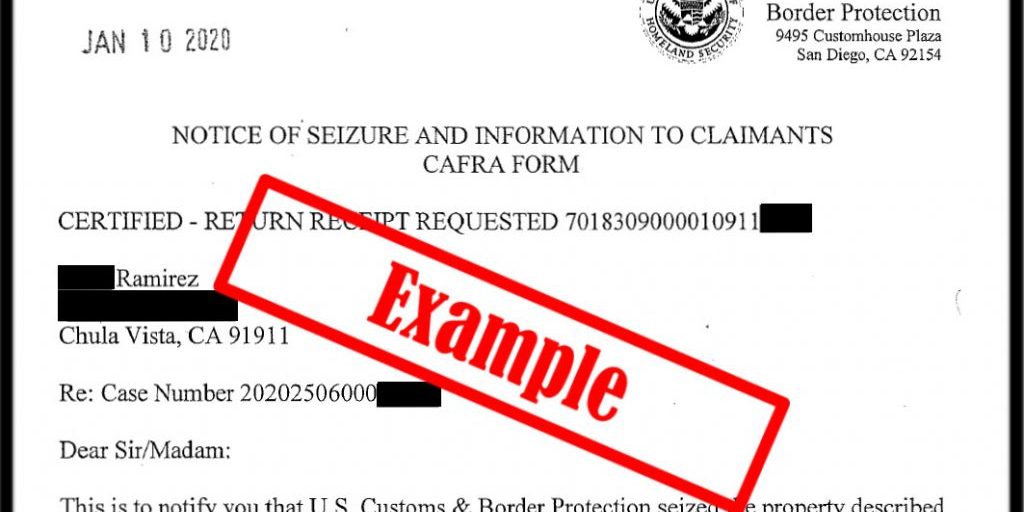

Example of the Text of a typical Notice of Seizure Letter

LEGAL NOTICE

NOTICE OF SEIZURE AND INTENT TO FORFEIT

U.S. DEPARTMENT OF HOMELAND SECURITY, U.S. CUSTOMS AND BORDER PROTECTION – Notice is hereby given as required by 19 U.S.C. § 1607 and 19 C.F.R. 162.45 of the seizure and intent to forfeit and sell, or otherwise dispose of according to law, the property described below which is determined to be used in or related to a violation of United States law. Any person having a legal interest therein and desiring to claim any of the listed property must appear at the U.S. Customs and Border Protection, Attention: Fines, Penalties and Forfeitures Officer, U.S. CBP/ATTN:FPFO, 9495 CUSTOMHOUSE PLAZA, SAN DIEGO, CA 92154-7631 within 30 days of the date of the first publication/posting and file a claim and cost bond in the sum of $5,000.00 or 10 percent of the value of the property, whichever is lower, but not less than $250.00. Unless such a claim is received by the above office by close of business on the date indicated below, the property will be declared forfeit to the United States and disposed of in accordance with the law.

PUBLICATION/POSTING START:

DEADLINE TO FILE A CLAIM: