What are your goals as a church leader? Are you passionate about ministering to others? Perhaps you want to offer hope to an entire community.

Like any organization, churches need a clear vision of their purpose and the tools to maintain legal compliance in order to achieve their goals. That’s why church incorporation is an important step in starting your church and furthering its mission. In this guide, we’ll cover everything you need to know about church incorporation, including:

Incorporation is important for every church, but it may look different depending on your church’s size, home state, and other circumstances. We’ll answer your questions in the guide below, but you can also talk to a professional for one-on-one advice about your church’s unique needs.

Incorporation is the process of creating a new legal entity. An incorporated organization is considered a legal “person,” meaning it holds the same rights and responsibilities as an individual. This status allows the organization to act as a formally organized entity and accept liability for its actions.

Church incorporation is the establishment of a church as its own, legal entity, separate from its founders or leaders. While incorporation isn’t necessary to start a church, there are many advantages to church incorporation.

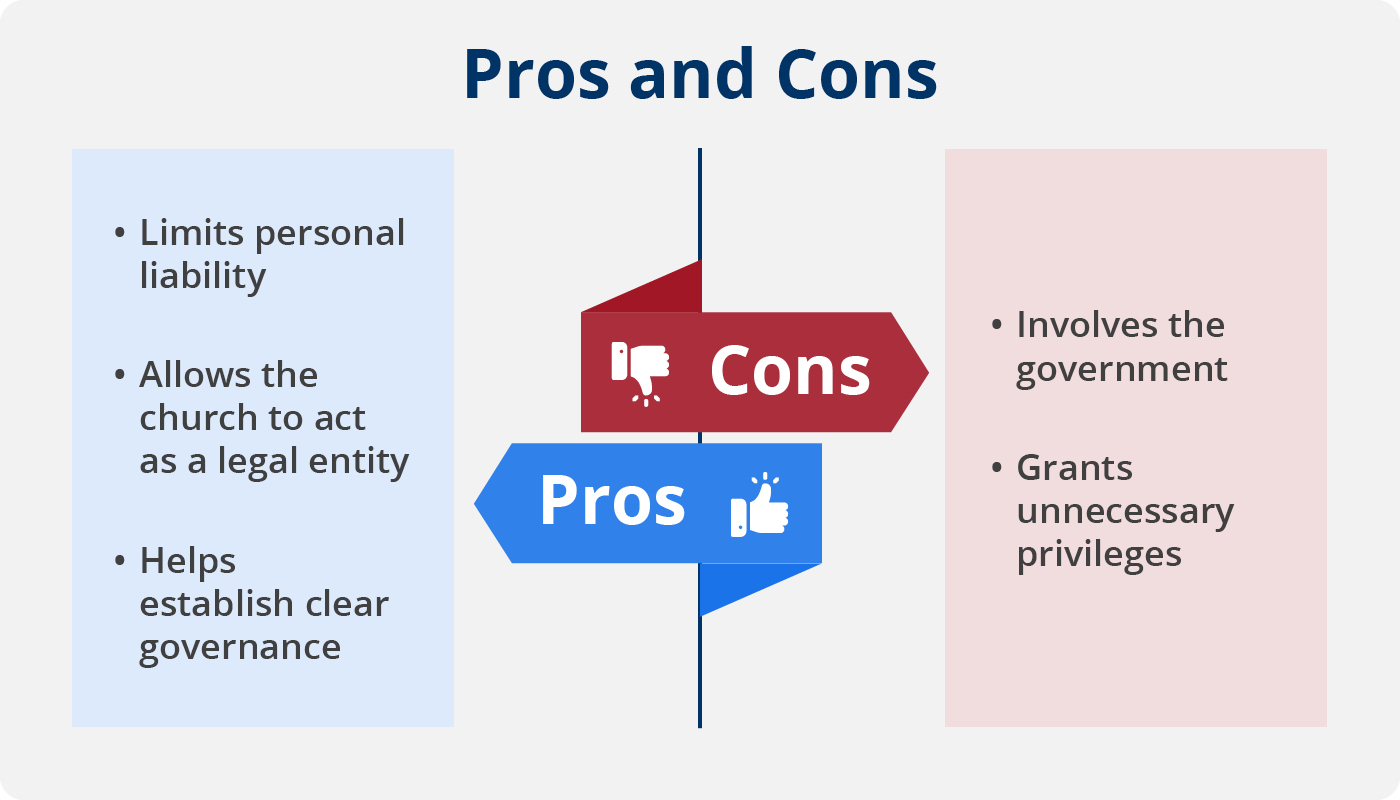

If you’re unsure of whether or not to incorporate your church, consider the pros and cons of incorporation:

In terms of advantages, church incorporation:

Some churches view the following as cons of incorporation:

Most compliance experts will agree that church incorporation has far more pros than cons. If you’re convinced of the need for incorporation, let’s explore what you’ll need to get started.

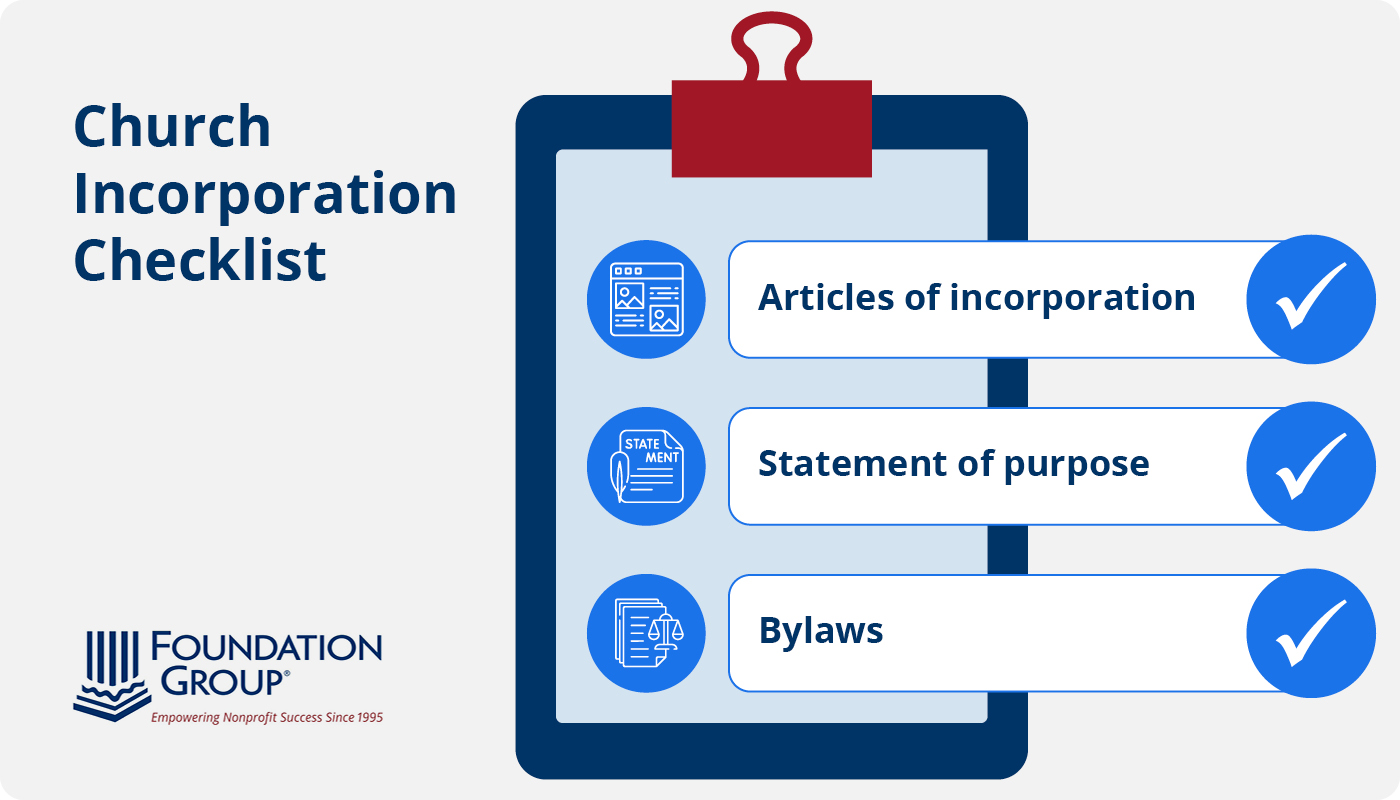

Church incorporation is enacted at the state level, meaning most churches must go through the Secretary of State’s office. However, the process includes more than just one simple filing—you’ll need additional documents that protect your church and establish its governance. Plus, you may have to continue filing a report every year to maintain corporate status.

To get started with church incorporation, you’ll need to prepare:

Don’t stop after incorporation. To maintain your status and ensure your church is set up to operate smoothly and properly, you’ll need to review these documents at least once a year. Your bylaws, for example, may need revisions to reflect and better serve your church’s mission.

Additionally, incorporation is a necessary stepping stone to other provisions for your church, like 501(c)(3) status. If you want official determination of 501(c)(3) status from the IRS, you’ll need to ensure you incorporate properly and maintain corporate status.

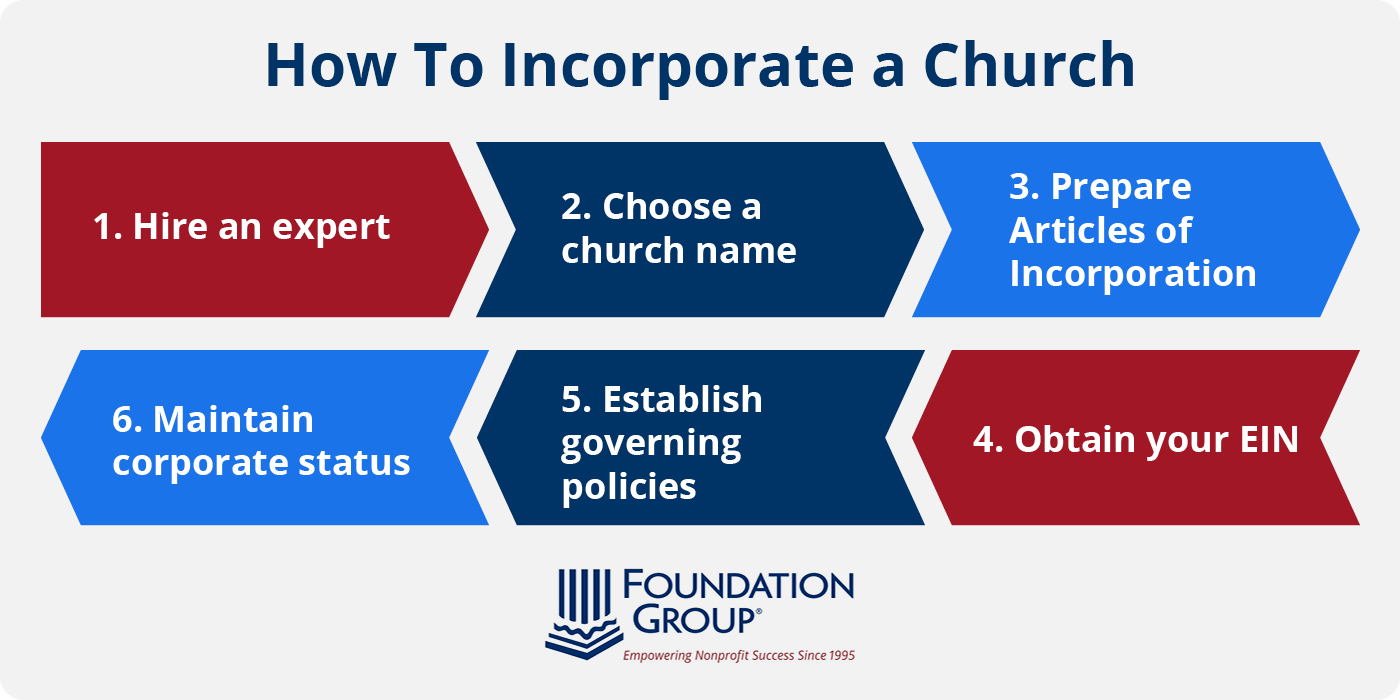

As you can see, church incorporation involves determining the purpose of your church and how it will operate. Failing to establish the proper provisions can negatively affect the future of your church, so you’ll want to approach it carefully. Consider the following six steps to church incorporation.

As part of the 501(c)(3) application process, incorporation can be handled with ease by compliance experts. This means that you won’t just receive professional guidance for incorporation, but also for obtaining official 501(c)(3) determination when you reach out to an expert for help.

Trusting a professional can help you:

At Foundation Group, we’ve helped over 25,000 startups, and incorporation is a core step every time. That’s because incorporation is a key component of our SureStart services. With Foundation Group’s SureStart services, you can focus on your ministry while the experts handle everything else, including checking name availability, obtaining your Employer Identification Number (EIN), writing your bylaws, and preparing your Articles of Incorporation.

If you’re getting started without the help of an expert, your first step in church incorporation will be to choose a church name. The name of your church must meet state requirements and can’t match the name of another incorporated organization.

As we discussed earlier, your church’s Articles of Incorporation officially deem your church incorporated. To prepare this document, you’ll typically need to provide:

Because each state determines its requirements for Articles of Incorporation, this list may vary depending on the state your church is in. A professional will likely have experience incorporating in several states and can ensure you include everything required by your state.

Your federal EIN is a unique, 9-digit number assigned by the IRS to identify your organization for tax purposes. Once you complete and submit the online application, you’ll receive your EIN. Be sure to download your EIN confirmation notice for your records.

You’ll establish your church’s purpose when filing the Articles of Incorporation, but you’ll also need a clear plan for how you’ll fulfill that purpose. That’s where bylaws come in.

These governing policies clearly outline how your church will operate and should be consistent with your Articles of Incorporation. Be sure to craft bylaws that are specific to your church and its beliefs, seeking input from your congregation if necessary. Your bylaws should thoroughly address the ground rules for decision-making concerning the church, clearly laying out positions of authority and determining how members will be held accountable.

After incorporating your church, you’ll need to maintain corporate status over time. File an annual report, or a Statement of Information, with your Secretary of State’s office each year. This document will include vital information about your church, including its activities throughout the year.

Since you’ll need to submit a comprehensive report of your church’s activities, you must practice effective recordkeeping throughout the year. This way, you’ll be prepared to submit an accurate report and avoid scrambling to find information for the filing. Your church may hire an expert for its recordkeeping needs, too.

Church incorporation is vital to protecting your church’s members and establishing a clear plan for your ministry. But if incorporation isn’t your forte, that’s okay! Outsourcing your church’s startup to a professional can ensure you navigate the process accurately and with ease.

If you’re interested in learning more about operating a church, check out the following resources: