Get to know MNSAVES

No matter your child’s age, the best time to open a MNSAVES account is today. Because the sooner you start, the more you can take advantage of compound earnings and unique tax benefits.

Start early to make the most of your savings

Saving early has the potential to deliver compounding earnings over a longer period of time.

529 fact

Help grow your savings with gifts from friends and family using Ugift ® .

Advantages of starting early

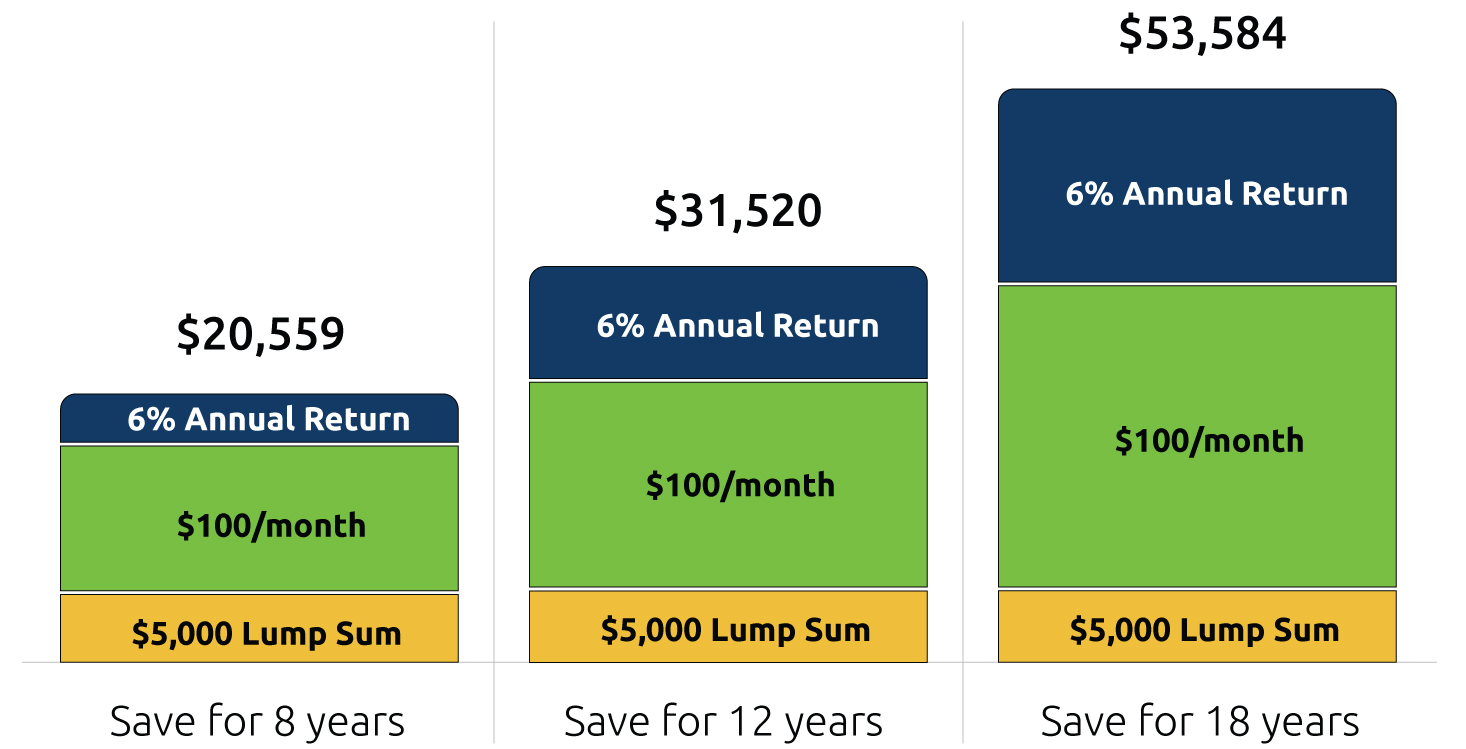

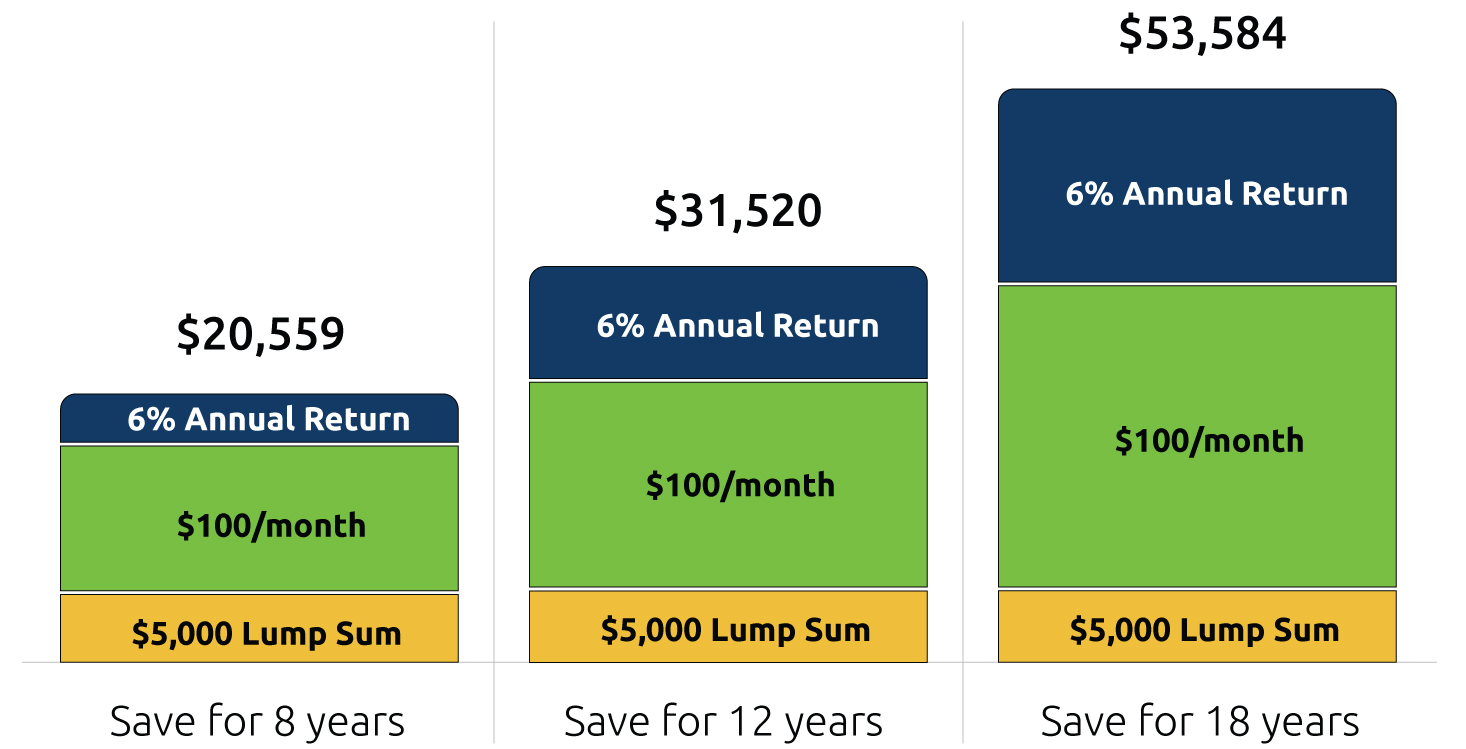

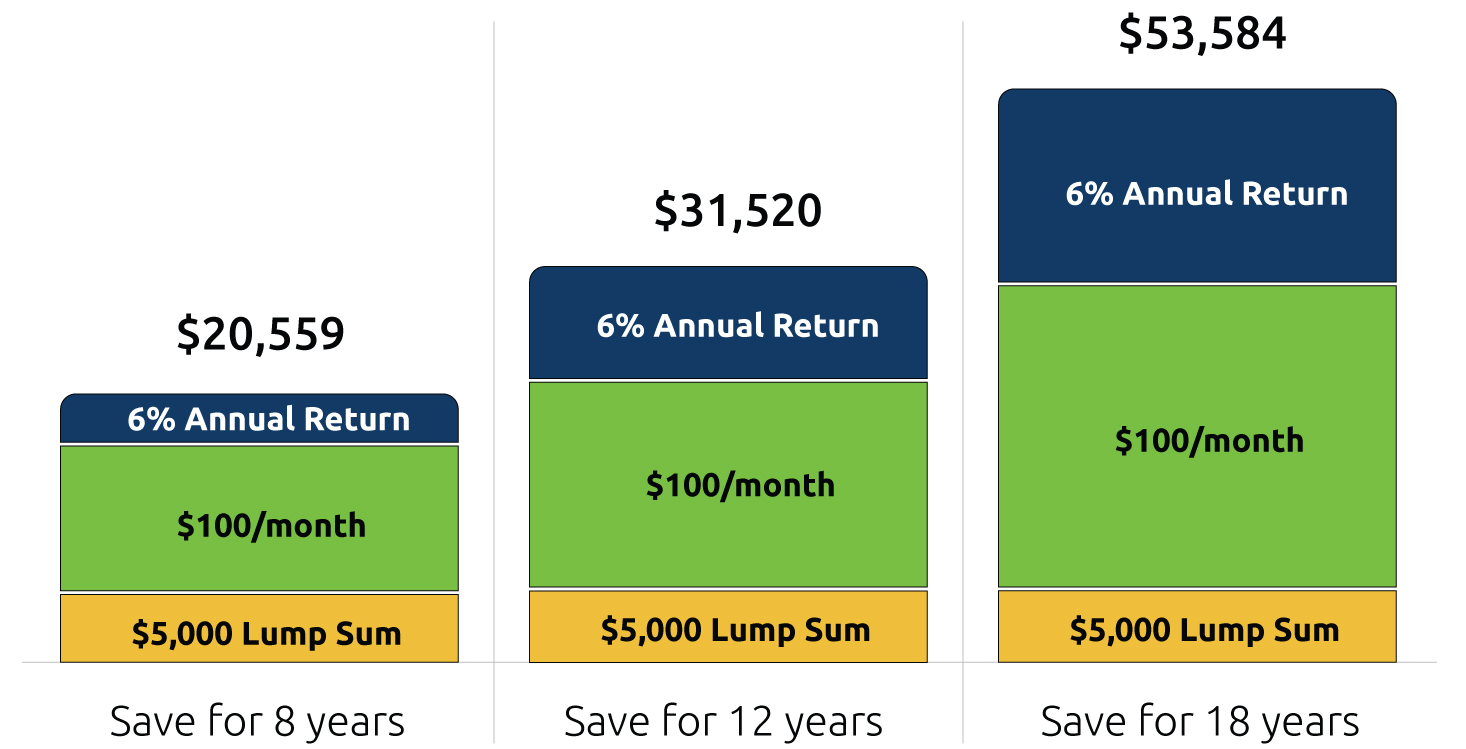

See how your savings might grow if you start with $5,000 and continue to save $100 a month for 8, 12 and 18 years.

- Earnings

- Subsequent Contributions

- Initial Contribution

Save for 8 years

- Earnings: 6% Annual Return

- Subsequent Contributions: $100 per month

- Initial Contribution: $5,000 Lump Sum

- Total savings growth over time: $20,559

Save for 12 years

- Earnings: 6% Annual Return

- Subsequent Contributions: $100 per month

- Initial Contribution: $5,000 Lump Sum

- Total savings growth over time: $31,520

Save for 18 years

- Earnings: 6% Annual Return

- Subsequent Contributions: $100 per month

- Initial Contribution: $5,000 Lump Sum

- Total savings growth over time: $53,584

Graph Footnotes

- This chart assumes a $5,000 lump sum investment, a $100 monthly investment and 6% annual rate of return. The calculations are for illustrative purposes only, and the results are not indicative of the performance of any investments. The calculations do not reflect any plan fees or charges that may apply. If such fees or charges were taken into account, returns would have been lower. With any long-term investment, investment return may vary. Such automatic investment plans do not assure a profit or protect against losses in declining markets. Account value in the investment options is not guaranteed and will fluctuate with market conditions.

How much should you save toward your child’s tuition?

Get a quick estimate of approximately how much you’ll need to save using our calculator tool.

Unique tax benefits

When you pay fewer taxes, you can potentially save more and grow your account faster—giving your child or grandchild an even bigger head start. MNSAVES offers compelling income tax benefits.

- Minnesota taxpayers can reduce their state taxable income up to $3,000 if married filing jointly ($1,500 filing single) for contributions made into a Minnesota College Savings Plan. 1

- Investment earnings are 100% free from federal and Minnesota state taxes when used for qualified education expenses. 2

See the MNSAVES Plan Description for more details on our unique tax benefits.

Who’s Eligible?

You, your friends, family, neighbors and more…basically any citizen or taxpayer over 18 can open or contribute to MNSAVES. Here are the details.

Account owners

- At least 18 years old with a valid Social Security Number (SSN) or taxpayer ID number

- Person opening the account can designate a successor account owner in the event of their death

- Certain trusts, estates, and corporations can also open an account with a valid taxpayer ID number *

Account Owner Footnote

- * Additional restrictions may apply; please refer to the Plan Description for details.↩

Beneficiaries

- The beneficiary is the student and only needs a valid SSN or taxpayer ID number

- It can be your child, grandchild, even you—and you don’t need to be related to the beneficiary

- Only one beneficiary to an account, except when an entity creates a general scholarship account

Contributors

- Anyone can help pay for college with our easy and secure Ugift® platform

- Gifting may also provide advantages for estate and legacy planning; please consult your tax advisor 3

An account can be opened in anyone’s name (like a parent, grandparent or family friend) and easily transferred later.

Qualifying Expenses

With MNSAVES, you have full control over how to use your funds. Here is the wide variety of qualified education expenses that can support your child in any path they choose to take:

- Tuition at any accredited private or public college or university, community college, technical college, graduate schools and professional schools across the U.S. and many abroad

- Certain room and board related expenses

- Fees, books, supplies and other equipment needed for enrollment and attendance

- Computers and related technology such as internet access fees, software or printers

- Certain additional enrollment and attendance costs for beneficiaries with special needs

- Pay for K-12 tuition expenses at a public, private or religious elementary, middle or high school—up to $10,000 annually federal tax-free. 4

- Pay for apprenticeship expenses federal tax-free—apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act. 4

Funds can also be used in two other helpful ways:

- Repay student loans—up to a $10,000 lifetime limit per individual federal tax-free (including principal and interest on any qualified education loan) 4

- Transfer additional/leftover funds to another eligible beneficiary such as another child, grandchild or even yourself

Please see the state tax treatment of withdrawals section in the Plan Description for more information.

See plan details for additional information

More to explore

Benefits of our 529

Make the most of every dollar you put toward college savings with MNSAVES.

Compare investment options

We make it easy to choose investment options that fit your financial needs and savings goals.

Ready to get started?

Have more questions?

Do I have to use my account at a Minnesota college or university?

No. Your MNSAVES funds can be used at any accredited university in the country—and even some abroad. This includes public and private colleges and universities, apprenticeships, community and technical colleges, graduate schools and professional schools. 1 Up to $10,000 annually can be used toward K-12 tuition (per student). 1 In addition, your 529 can be used for student loan repayment up a $10,000 lifetime limit per individual. 1 Review a list of qualifying expenses and the state tax treatment of withdrawals for these expenses in the Plan Description.

Footnotes

- 1 Withdrawals for tuition expenses at a public, private or religious elementary, middle, or high school, registered apprenticeship programs, and student loans can be withdrawn free from federal taxes. For Minnesota taxpayers, these withdrawals are subject to recapture of tax deduction/credit and state income tax on the earnings. You should talk to a qualified professional about how tax provisions affect your circumstances.↩

What if my child decides not to attend college?

With your MNSAVES account, you’re never locked in. You’ll always have access to several options for this money:

- Your funds can be used to pay for a variety of eligible education expenses, including at any accredited college, university, apprenticeships, community or technical college and postgraduate program in the United States—and even some schools abroad. 1

- Your 529 can be used for student loan repayment up a $10,000 lifetime limit per individual. 1

- Up to $10,000 annually can be used toward K-12 tuition (per student). 1

- You can transfer the funds to another eligible beneficiary, such as another child, a grandchild or yourself.

- If you just want the money back, you can withdraw the funds at any time. If funds are withdrawn for a purpose other than qualified higher education expenses, the earnings portion of the withdrawal is subject to federal and state taxes plus a 10% additional federal tax on earnings (known as the “Additional Tax”). See the Plan Description for more information and exceptions.

- Or you can always wait because the funds never expire, and often the choice to go to school is a delayed decision. So, if your child changes their mind down the road, your account will still be available.

- Effective January 1, 2024, Account owners may roll money from a MNSAVES account to a Roth IRA for the benefit of the 529 plan account beneficiary without incurring federal income tax or penalties (state tax treatment varies). For the rollover to be treated as a non-taxable event, certain conditions apply as referenced in Am I eligible to rollover funds from my 529 plan account to a Roth IRA?2

Footnotes

- 1 Withdrawals for tuition expenses at a public, private or religious elementary, middle or high school, registered apprenticeship programs and student loans can be withdrawn free from federal taxes. For Minnesota taxpayers, these withdrawals are subject to recapture of tax deduction/credit, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

- 2 The TIAA group of companies and the Minnesota 529 College Savings Plan do not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances↩

How do I know which educational institutions are eligible?

Your MNSAVES account can be used at eligible colleges, universities, technical and community colleges, graduate or postgraduate programs, apprenticeships and more. 1 Contact your school to determine whether it qualifies as an eligible educational institution or use the Federal School Code Search tool on the Free Application for Federal Student Aid (FAFSA) website.

Footnotes

- 1 Withdrawals for registered apprenticeship programs can be withdrawn free from federal taxes. For Minnesota taxpayers, these withdrawals are subject to recapture of tax deduction/credit, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

Are there any fees associated with opening a MNSAVES account?

There are no sales charges, startup fees or maintenance fees associated with MNSAVES accounts. For details on total annual asset-based fees, comprised of the underlying investment expenses for each investment option, the plan manager fee and Minnesota administrative fee, review the Fee Table in the Plan Description.

Want more time before getting started? Sign up to receive information on an MNSAVES plan and college savings tips.

Why MNSAVES

- Benefits of Our 529

- A Plan for Everyone

- About Us

Learn & Plan

- How Our 529 Works

- Compare Ways to Save

- The Cost of College

Investment Options

- Compare Investment Options

- Enrollment Year Investment Options

- Multi–Fund Investment Options

- Single–Fund Investment Options

- Principal Plus Interest Option

- Daily Price & Performance

- Fees & Expenses

Resources

- Popular Resources

- Planning Tools

- FAQs

- Gifting

- Events & Webinars

- Glossary

- Financial Professionals

- Schedule an Appointment

Account Center

Need Help?

Follow Us

Access your account on–the–go with the ReadySave 529™ App

- Managed by TIAA–CREF Tuition Financing, Inc. (TFI)

- Privacy Policy

- Accessibility Statement

- Sitemap

- Security Center

- Plan Description

Disclosures

Footnotes

- Ugift is a registered service mark of Ascensus Broker Dealer Services, LLC.

- 1 Minnesota taxpayers can reduce their state taxable income up to $3,000 if married filing jointly ($1,500 filing single) for contributions made into a Minnesota College Savings Plan or may be eligible for maximum credit amount up to $500, subject to phase-out based on certain federal adjusted gross income thresholds.↩

- 2 If the funds aren't used for qualified higher education expenses, a federal 10% penalty tax on earnings (as well as federal and state income taxes) may apply.↩

- 3 For the tax year 2024, there’s no federal gift tax on contributions made up to $18,000 per year for a single filer, or $36,000 for a married couple. You can also accelerate your gifting with a lump sum gift of $90,000 for a single filer or $180,000 for a married couple and pro-rate the gift over five years per the federal gift tax exclusion.↩

- 4 Withdrawals for tuition expenses at a public, private or religious elementary, middle, or high school, registered apprenticeship programs, and student loans can be withdrawn free from federal taxes. For Minnesota taxpayers, these withdrawals are subject to recapture of tax deduction/credit and state income tax on the earnings. You should talk to a qualified professional about how tax provisions affect your circumstances.↩

For more information about the Minnesota College Savings Plan, call 1-877-338-4646 or click here for a Plan Description which includes investment objectives, risks, charges, expenses, and other important information. Read and consider it carefully before investing.

Please Note: Before you invest, consider whether your or the beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state’s qualified tuition program. You should also consult your legal or tax professional for tax advice based on your own circumstances. Investments in the plan are neither insured nor guaranteed and there is the risk of investment loss.

If the funds aren’t used for qualified higher education expenses, a 10% penalty tax on earnings (as well as federal and state income taxes) may apply.

The Minnesota College Savings Plan is offered by the State of Minnesota. TIAA-CREF Tuition Financing, Inc. (TFI), program manager. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributor and underwriter for the Minnesota College Savings Plan.

The Plan Web site contains links to other Web sites. Neither the Plan nor TFI and its affiliates are responsible for the content of those other Web sites. The accuracy of information on those sites cannot be confirmed.

All social media platforms are managed by the State of Minnesota.